Introduction

Finance and compliance have always been at the heart of business operations. These domains ensure that organizations run efficiently, legally, and ethically. However, as industries grow more complex and regulations become stricter, the need for innovation in these fields has never been greater. Enter Revolutionizing Finance and Compliance — a transformative approach that leverages cutting-edge technologies and forward-thinking strategies to tackle long-standing challenges. This revolution isn’t merely an upgrade; it’s a reimagining of how we manage finances, ensure compliance, and future-proof businesses.

This article delves into the importance of this transformation, the technologies driving it, and actionable insights for businesses ready to embrace the change.

The Need for Change

Traditional finance and compliance systems, while functional, are often bogged down by inefficiencies, manual processes, and a lack of scalability.

Key Challenges in Traditional Approaches

- Error-Prone Processes

Manual data entry, calculation errors, and oversight during audits lead to inaccuracies that can have costly repercussions. - Regulatory Overload

With regulations varying across industries and countries, staying compliant is a Herculean task for global businesses. - Resource-Intensive Operations

Managing finance and compliance involves significant time, effort, and money, leaving fewer resources for innovation and growth. - Reactive Approach

Traditional systems often identify issues after they occur, leading to reactive problem-solving rather than proactive management.

These pain points underline the urgency of Revolutionizing Finance and Compliance to meet the demands of today’s fast-paced, data-driven world.

What Does Revolutionizing Finance and Compliance Entail?

At its core, this revolution involves the integration of advanced technologies to streamline processes, improve accuracy, and enhance decision-making. But it’s more than just technology; it’s a shift in mindset toward agility, transparency, and efficiency.

Key Features of the Revolution

- Automation

Replacing manual processes with automated systems reduces errors and frees up human resources for strategic tasks. - Real-Time Data Insights

Advanced analytics tools provide immediate access to financial and compliance data, enabling faster and more informed decisions. - Proactive Compliance

AI-driven compliance solutions monitor regulatory changes and flag potential risks before they become issues. - Scalability and Flexibility

Cloud-based systems allow businesses to scale their operations seamlessly while maintaining compliance. - Enhanced Security

Technologies like blockchain ensure secure, tamper-proof records, safeguarding sensitive financial data.

By implementing these features, organizations can transform finance and compliance from a cost center into a strategic advantage.

The Role of Technology in Revolutionizing Finance and Compliance

Technology is the backbone of this transformation, offering tools and systems that address traditional challenges and open up new possibilities.

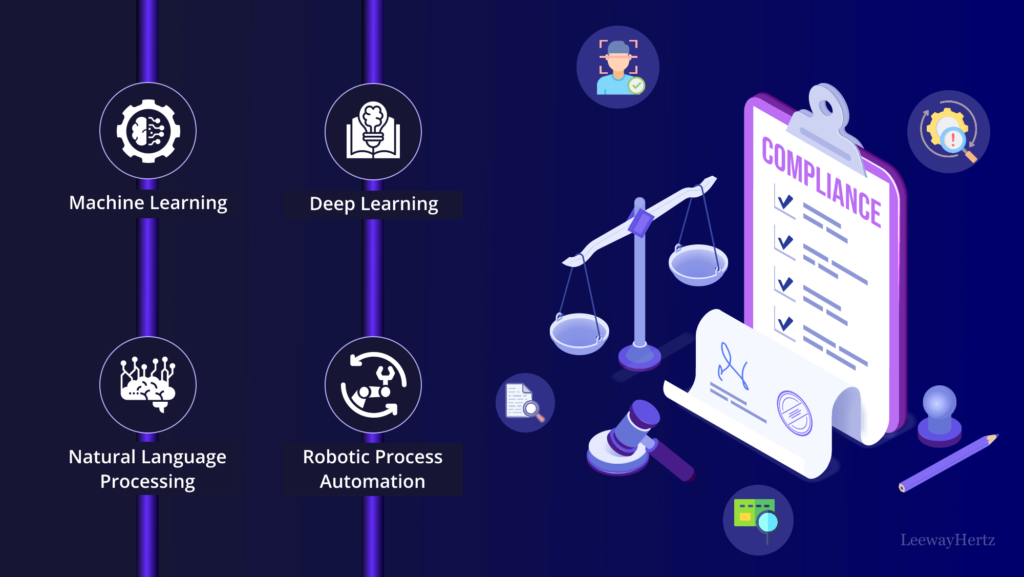

1. Artificial Intelligence (AI)

AI is revolutionizing how businesses manage finance and compliance by automating repetitive tasks and providing deep insights.

Applications of AI:

- Fraud Detection: AI algorithms analyze transactions to identify anomalies and prevent fraud.

- Regulatory Monitoring: Machine learning tools track changes in regulations, ensuring businesses stay compliant.

- Predictive Analytics: AI forecasts financial trends, helping businesses make informed decisions.

2. Blockchain Technology

Blockchain brings transparency, security, and efficiency to finance and compliance.

Benefits of Blockchain:

- Immutable Records: Transactions and compliance records are tamper-proof.

- Smart Contracts: Automating contract execution reduces delays and errors.

- Enhanced Audit Trails: Blockchain provides real-time, traceable data for audits.

3. Cloud Computing

Cloud-based platforms enable businesses to access data and tools from anywhere, promoting collaboration and flexibility.

Advantages of Cloud Solutions:

- Cost Savings: Pay-as-you-go models reduce upfront investment.

- Scalability: Easily expand systems as business needs grow.

- Real-Time Collaboration: Teams can work together on financial and compliance tasks, regardless of location.

4. RegTech (Regulatory Technology)

RegTech simplifies compliance through automation and analytics.

Key Features of RegTech:

- Risk Management: Identify and mitigate risks proactively.

- Regulatory Reporting: Generate accurate reports with minimal effort.

- Compliance Dashboards: Provide a comprehensive view of compliance status.

These technologies form the foundation of Revolutionizing Finance and Compliance, empowering businesses to operate smarter, faster, and more securely.

Benefits of Embracing the Revolution

Adopting innovative finance and compliance practices offers a plethora of advantages that extend beyond operational efficiency.

1. Improved Accuracy

Automation and AI eliminate human errors, ensuring data integrity and reliable compliance.

2. Cost Reduction

Streamlined processes reduce the need for extensive manual labor and expensive audits.

3. Faster Decision-Making

Real-time insights allow businesses to act quickly on financial trends and regulatory updates.

4. Enhanced Security

Blockchain and encryption safeguard sensitive financial data, boosting trust among stakeholders.

5. Global Scalability

With cloud-based systems, businesses can expand globally without worrying about compliance gaps.

6. Competitive Edge

Early adopters of advanced finance and compliance systems gain a significant advantage in efficiency, customer trust, and innovation.

These benefits highlight why Revolutionizing Finance and Compliance is more than a trend—it’s a strategic imperative.

Real-World Applications

The transformation isn’t confined to theory. Many industries are already reaping the rewards of modernized finance and compliance systems.

Financial Institutions

Banks use AI to detect fraudulent activities and streamline loan approvals, reducing turnaround times and enhancing customer satisfaction.

Healthcare

Hospitals and clinics leverage blockchain to ensure the secure storage and sharing of patient data, maintaining compliance with privacy regulations like HIPAA.

Retail and E-Commerce

Retailers adopt cloud-based accounting tools to manage finances and meet tax compliance requirements seamlessly.

Startups and SMEs

Small businesses benefit from affordable RegTech solutions that automate compliance, allowing them to focus on growth.

These examples demonstrate how Revolutionizing Finance and Compliance drives success across diverse sectors.

Overcoming Challenges

While the benefits are compelling, transitioning to modern finance and compliance systems isn’t without its challenges.

1. High Initial Costs

Adopting advanced technologies requires a significant upfront investment, which may deter small businesses.

Solution:

Start small with scalable solutions that grow with your business.

2. Resistance to Change

Employees and stakeholders may be hesitant to adopt new systems.

Solution:

Invest in training and communicate the long-term benefits to gain buy-in.

3. Data Privacy Concerns

With increased reliance on digital systems, protecting sensitive data becomes critical.

Solution:

Implement robust cybersecurity measures and comply with data protection regulations.

By addressing these challenges proactively, businesses can ensure a smooth transition toward Revolutionizing Finance and Compliance.

A Roadmap to Revolutionizing Finance and Compliance

Ready to embark on this transformative journey? Follow these steps to ensure success:

1. Assess Your Current Systems

Identify gaps and inefficiencies in your existing finance and compliance processes.

2. Set Clear Goals

Define what you aim to achieve—be it cost reduction, improved accuracy, or scalability.

3. Choose the Right Technologies

Select tools and platforms that align with your business needs and objectives.

4. Train Your Team

Equip employees with the skills needed to operate new systems effectively.

5. Monitor and Optimize

Continuously evaluate the performance of your new systems and make necessary adjustments.

The Future of Finance and Compliance

The journey to Revolutionizing Finance and Compliance is far from over. As technology evolves, new opportunities and challenges will emerge.

Emerging Trends

- AI-Powered Personalization: Tailoring financial solutions to individual needs.

- Green Compliance: Integrating sustainability into compliance practices.

- Quantum Computing: Enhancing data security and processing capabilities.

The Human Element

Despite technological advancements, human expertise remains irreplaceable. Businesses must strike a balance between automation and human judgment to achieve optimal results.

Conclusion

The era of Revolutionizing Finance and Compliance is here, offering businesses an unprecedented opportunity to enhance efficiency, accuracy, and agility. By embracing advanced technologies and adopting a forward-thinking mindset, organizations can overcome traditional challenges and thrive in an increasingly competitive landscape.

This transformation isn’t just about keeping up; it’s about staying ahead. The time to act is now.

So, are you ready to revolutionize your finance and compliance strategies? Take the first step today and position your business for a brighter, more secure future.